TransferWise overview: international transfers and multi-currency debit card

October 11, 2019

Perhaps you, like me, have heard something about TransferWise and the multi-currency card and want to understand these issues. I hope my little note will help you with this.

At first glance, TransferWise seemed like a very interesting topic:

- cheap international transfers

- multicurrency debit card

local details in a number of countries (in another country, money can be credited to your account as if a person were making a transfer to local details)

TransferWise is a service for making international money transfers. Why another service if you have WesternUnion, PayPal and others?

The key features of TransferWise are:

- good currency conversion rate

- low commission for transfers

Indeed, bank international transfer, as well as transfers through WesternUnion (due to hidden fees in the currency conversion rate) and PayPal (for international transfers, the commission is very high) is very expensive.

Comparison of Western Union and PaySend commissions showed that PaySend is much better than Western Union, that is, when sending the same amount, more will be credited via PaySend transfer.

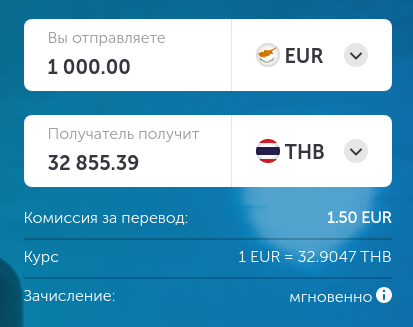

But if you compare PaySend with TransferWise, it turns out that the latter is even better! For example, sending thousands of euros to Thai Baht with PaySend:

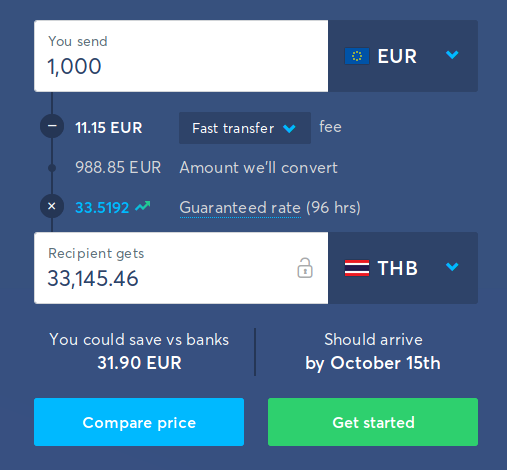

Sending the same amount via TransferWise:

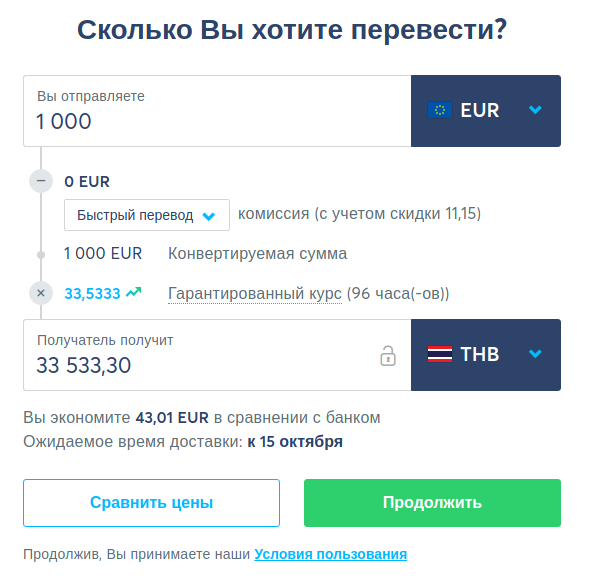

And sending the same amount through TransferWise with a free commission (when registering using this link, the first transfer will be free):

That is, the most profitable international transfers can be done with TransferWise!

That is, it turns out that PaySend also lays a hidden commission in the currency conversion rate. And Western Union lays an even larger commission on the conversion rate.

Let me say about some disadvantages of TransferWise: when paying with a card, an additional fee is charged, transfers take a long time and they can only be sent to bank details (cannot be sent to a card, as in PaySend).

I prepared the following comparison table between PaySend and TransferWise:

| PaySend | TransferWise | |

|---|---|---|

| To register, you need an ID | No | Yes |

| The beneficiary's bank details are required | No, the transfer is credited to the beneficiary's card | Yes |

| Instant transfer credits | Yes | No |

| Number of supported countries | Money can be sent from 49 countries to 70 countries | Money can be sent from 24 currencies to 58 countries |

| Can I transfer money from a bank card | Yes | Yes, but only with an additional commission |

| The amount of the commission | Fixed, about 1 US dollar (depending on the currency of sending) | Depends on the method of sending (bank transfer or from a card), as well as on the amount of transfer |

| Currency conversion rate | Better than WesternUnion, but worse than TransferWise | Better than WesternUnion and better than PaySend |

| First free translation | Yes (by promo code (0d8425) | Yes, when registering at this link. |

Multicurrency app and TransferWise card

TransferWise allows you to have accounts in dozens of currencies and convert your money from one currency to another (with commissions). There is also a function of obtaining local bank details for the British pound, US dollar, euro and a pair of other currencies. This means, for example, if you work as a freelancer and receive an order from the United States, then the customer can pay your work for your details in dollars, and for him it will be a local (made within the country) payment! For you, this money will go to a multi-currency application, where you can convert it to another currency and send it to any of your accounts. Or spend them by shopping with a debit card.

To my great regret, the list of countries where they deliver the map is very small. You can find the current list on this page. There are only Europe and the USA.

Conclusion

If you are a freelancer and work with customers all over the world, then the multi-currency TransferWise card ‘must have’ for you!

Related articles:

- I wanted to advertise Wise (TransferWise), but I could not make a transfer... (100%)

- How to send money to another country cheaply (61.1%)

- PaySend Invite code: 0d8425 (61.1%)

- International PaySend transfers - real customer feedback (2.5 years of experience, dozens of transactions) (61.1%)

- Bank accounts in Thailand: how to open, costs, features (53.3%)

- Cashback on airline tickets and hotels (RANDOM - 50%)