International PaySend transfers - real customer feedback (2.5 years of experience, dozens of transactions)

March 7, 2021

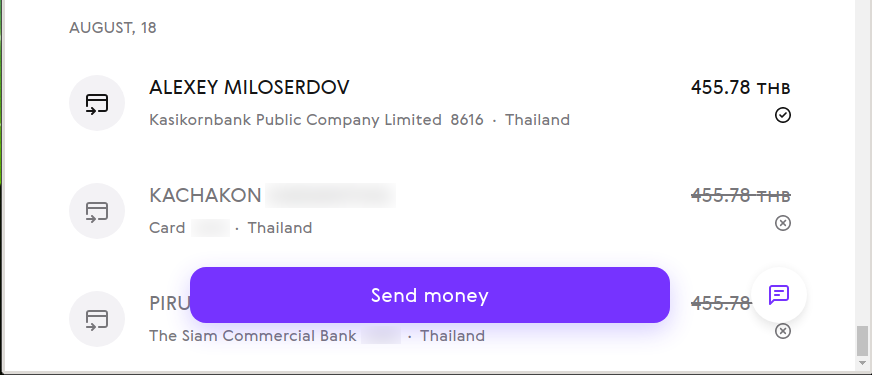

As you can see from this screenshot, I first used PaySend in August 2018.

Since then, I have learned how to send money without bank fees, I compared the hidden fees of Western Union with PaySend and it turned out that PaySend is more profitable. In general, I have been actively using PaySend for 2.5 years, during which I have made dozens of international transfers.

PaySend is my main way of transferring money abroad. Therefore, I have a story to tell.

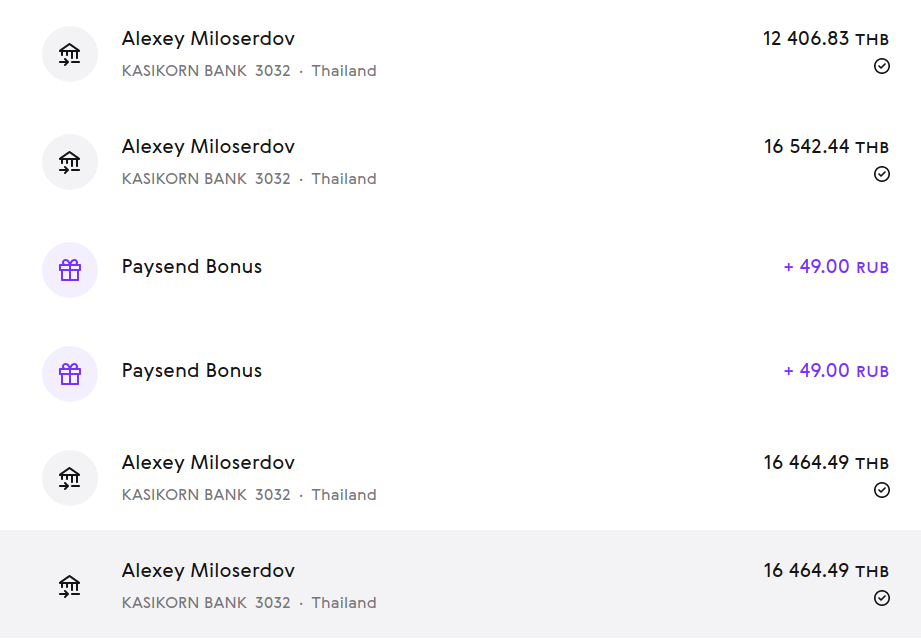

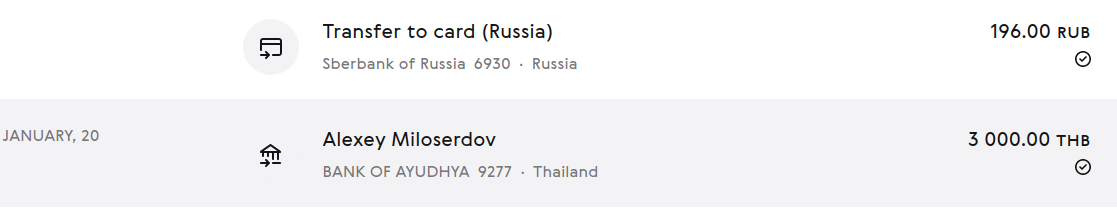

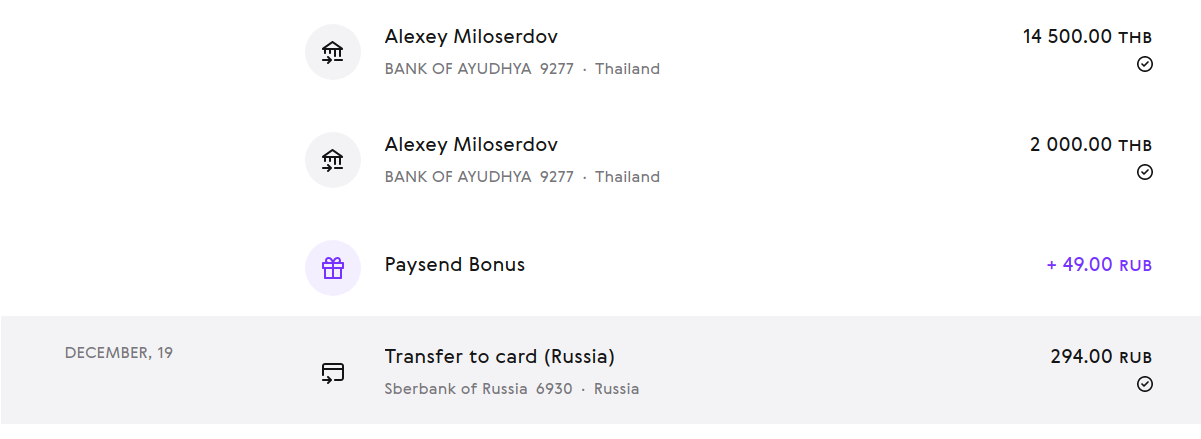

Here are examples of my translations:

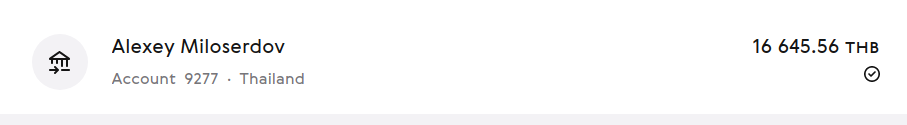

January 2020:

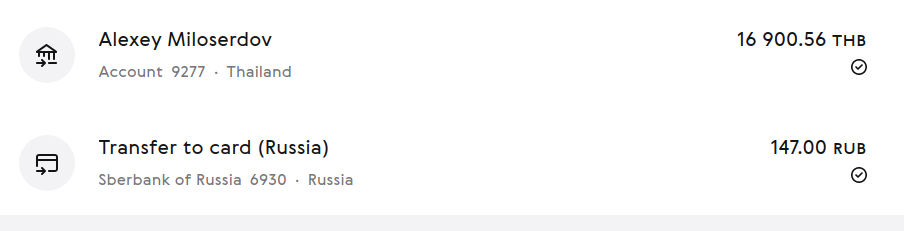

December 2019:

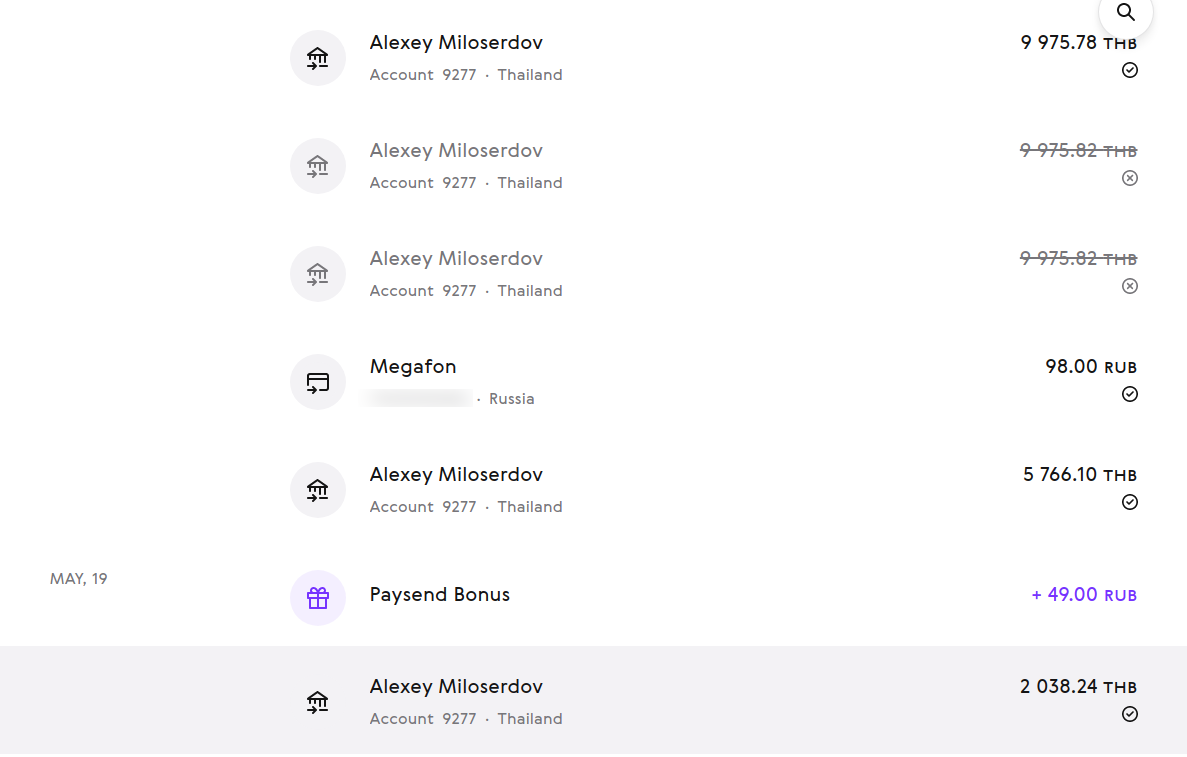

August 2019:

May 2019:

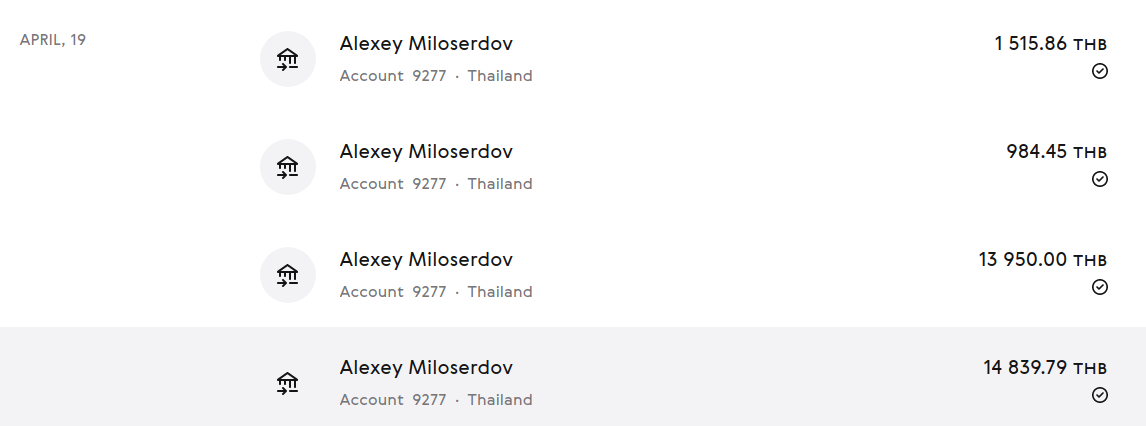

April 2019:

That is, there were large and small translations. Successful and sometimes failed.

Failed PaySend transfers

The most important thing to say about failed PaySend transfers, all money was returned in full to the original card. I didn't need to take any action.

Some transfers did not go through due to the size of the amount. Transfers were rejected by the recipient bank several times. In the first case, the money was returned to the card immediately. In the second case, the money was returned when the recipient bank rejected it.

For example, empirically it turned out that Sberbank easily passes the amount of 40 thousand rubles from a plastic card, and transfers for large amounts are not possible. But several transfers of 40 thousand rubles per day can be made.

Hidden fees

At the very beginning of working with PaySend, I noticed that the conversion currency rates from PaySend are much more profitable for the sender than from Western Union, in which the currency conversion rate includes a large hidden commission.

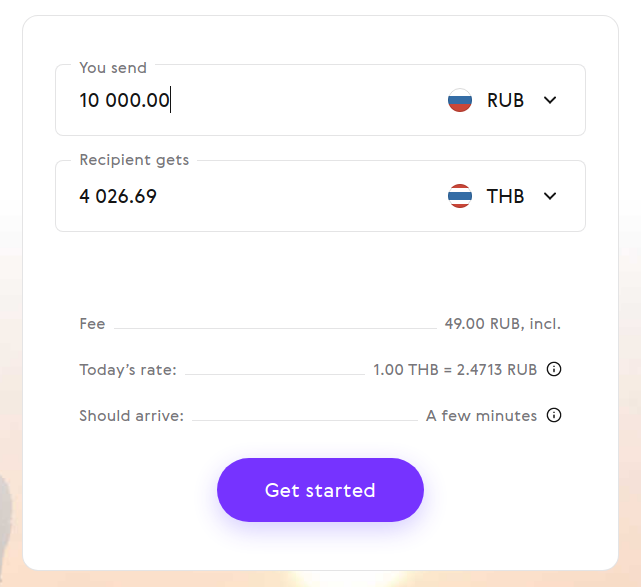

See for yourself, when sending 10,000 rubles via PaySend, I will receive 4026.69 THB:

And when sending 10,000 rubles through Western Union, I will receive 3889.42 THB:

The difference is 137.27 THB, from 100,000 rubles there would be a difference of 1372.7 baht, that is, thanks to PaySend, you can save $45 - this is very good.

In general, currency conversion rates are still quite acceptable. And if you compare with bank transfers and their commissions, then everything in PaySend is just fine.

Convenience

PaySend has no competitors here. Even if we compare it with Western Union, where now you can also send money to a bank account (no need to go to a special office), using Western Union causes some difficult sensations - a slow website, some awkward login procedure, short sessions, regular failures in work (with Western Union I also have a lot of experience, but PaySend won the competition and now I do not use Western Union).

Everything just flies in PaySend.

Tips for using PaySend

Although the PaySend commission is tiny - about $1 regardless (!) of the transfer amount, you can save even on it.

You can send without commission:

- First payment using Invite code 0d8425

- All international payments by bank details (and not by card number)

- Once a month to a Mastercard for international transfers

- 1 transfer without commission if you specify and confirm e-mail

- Invite code for one free international transfer (can be the second, third and any subsequent): PS10

Conclusion

In general, I definitely recommend PaySend for international payments. It is convenient, simple, fast, cheap and safe.

PaySend Invite code for the first transfer without commission: 0d8425

Related articles:

- How to withdraw more cash from an ATM in Russia (89.2%)

- How to send money to another country cheaply (65.3%)

- PaySend Invite code: 0d8425 (65.3%)

- TransferWise overview: international transfers and multi-currency debit card (65.3%)

- I wanted to advertise Wise (TransferWise), but I could not make a transfer... (65.3%)

- Western Union Error “There is a technical problem. Please try again later. ” (RANDOM - 54.5%)